- Global Markets: LNG Buyers in Asia Look to Resell Supply

- Global Oil & Gas: EU Rules on Methane Curbs May Boost LNG Industry - Exxon

- Global Oil & Gas: Venture Global Accused of Reneging on LNG Contracts for Europe

- Global Oil & Gas: Oil Unchanged as Market Struggles for Direction

- Energy Transition: Projections of peak oil, gas, and coal demand before 2030 deemed ‘extremely risky and impractical’

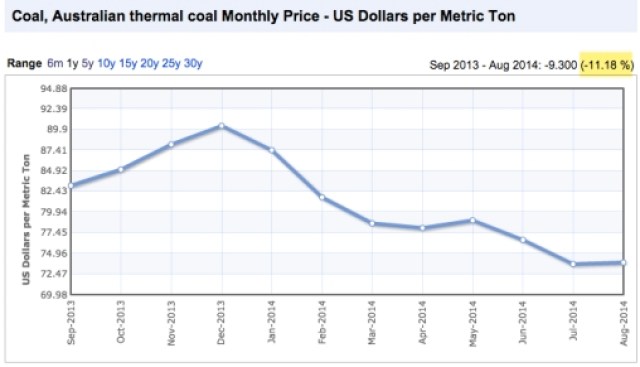

OILPRICE: New Chinese Coal Import Tax Spells Disaster For Australian Miners

China’s bombshell decision to impose tariffs on coal imports could prove to be the tipping point for Australian miners already struggling to stay afloat. The move by the economic powerhouse to introduce the new duty of between 3% and 6% beginning Wednesday shocked and angered Aussie producers, responsible for a quarter of Chinese coal imports.

The Minerals Council of Australia’s Brendan Pearson said the decision was a poor one.

“The MCA urges the Australian government to initiate urgent discussions with Chinese counterparts to seek the reversal of the decision,” he said in a statement.

He said applying tariffs would ultimately prove “counterproductive” for the struggling Chinese economy anyway because it would “raise energy costs for China’s industrial sector and households.”

The move comes barely a week after Beijing announced a major overhaul of its current resource tax, adding that the new and simpler levy would be effective Dec. 1.

This week’s sudden announcement represents a second major blow for countries exporting coal to China, after last month Beijing imposed a ban on selling or transporting low-grade or “dirty” coal, putting further pressure on the global coal market.

Alarm over that policy – announced last month – faded after Beijing appeared to exempt power plants, the largest consumers of fossil fuel.

China’s dependence on coal is well known. Annual consumption exceeded 1 billion short tons per year in 1988 and has exploded since then, to about 4 billion tons last year. This means the Asian giant gets about 70% of its energy from the fossil fuel, a number the government hopes to reduce to 65% by 2017.

In the past three years Australia’s coal industry has experienced challenging times with prices for thermal coal, which is consumed by power stations to generate electricity, dropping over 40%. More than 10,000 coal jobs have been lost in Australia since 2011 as companies slash costs and idle mines amid a global supply glut.

By Cecilia Jamasmie

(Source: http://www.mining.com/)